Bitcoin ($BTC) fell below $21.000 ($20,193.23) on June 15, and Ethereum’s Ether ($ETH) has traded for a minimum of $1,023.18 this Wednesday. On Friday (June 17) 2022 Bitcoin dropped to $20,282.52 while also showing a 24h high of $22,160.67. The Financial Times (FT) confirmed that crypto hedge fund Three Arrows Capital 3AC failed to meet margin calls((

Oliver, J. (2022). Crypto hedge fund Three Arrows fails to meet lender margin calls. [online] @FinancialTimes. Available at: https://www.ft.com/content/126d8b02-f06a-4fd9-a57b-9f4ceab3de71 [Accessed 30 Jun. 2022].)).

The chaos on the markets is still unfolding, and experts are blaming different factors that came together to create this massive market meltdown in crypto. But not only cryptocurrency is affected – the S+P500 fell to levels of Q4 2020, and still is in further decline.

What made Bitcoin drop to 20K in 2022? What more to expect in Crypto Winter of 2022?

Rising inflation, interest rate hikes, and geopolitical instability caused by the Ukraine war could be to blame

Fortune Magazine

An overview of reasons for the crypto market meltdown of 2022

- DeFi and Cascading Defaults

- Celsius Protocol stopped withdrawals, hired restructuring lawyers

- Justin Sun’s USDD and other Stablecoins are losing their pegs

- Staked Ether stETH from Lido Finance caused cascading defaults

- Major players defaulting and getting margin called

- 3AC Three Arrows Capital((Hetzner, C. (2022). ‘Working this out’: Major crypto hedge fund just gave a cryptic answer over whether it will implode. [online] Fortune. Available at: https://fortune.com/2022/06/15/crypto-3ac-three-arrows-capital-hedge-fund-insolvency-margin-call-bankruptcy-collapse-celsius/ [Accessed 30 Jun. 2022].))

Rising inflation, interest rate hikes

Federal Reserve Fed announced the biggest rate hike in 28 years (since 1994)

The perfect storm of FUD

New York Times wrote that “cryptocurrencies melt down in a ‘Perfect Storm’ of fear and panic” (New York Times, 2022-05-12) – but the situation has different reasons. 2022 has not been particularly bullish for crypto, with Terra, LUNA & UST already setting the stage.

Setting the stage: the Terra Luna meltdown

In a coordinated attack a threat actor had exploited Anchor Protocol, and initiated a buying spree of BTC, as well as an executed $4.2 bn short position to benefit from the bank-run that would follow.

As a result, the algorithmic Stablecoin Terra USD (UST) lost the peg to the US dollar dragging the whole crypto market with it (you can read information from Forbes, Bloomberg, Coindesk and CNBC about the topic). UST was created by Singapore-based Terraform Labs in 2018 as “algorithmic stablecoin” and was meant to track the value of the US dollar, as part of the Terra blockchain project. Terraform Labs (TFL) is the organization behind UST, cryptocurrency LUNA, and Luna Foundation Guard (LFG). LFG liquidated 42,530 bitcoin, or $1.3 billion on May 9, and further drained their Luna Foundation Guard (LFG) Reserves from roughly 4bn to 100M. The value locked in Anchor (Terra’s largest DeFi protocol) dropped for $14 bn in the days that followed. The crypto market reacted with massive selloffs, and Futures traders lost $106 million on Terra’s LUNA in the past 24 hours as prices fell below $7 ($5 at the time of writing). The Luna Foundation Guard is looking to raise more than $1 billion to stabilize the asset, and the market cap of $LUNA was further declining. We know how the story ended, but that is not all of it. Essentially, a lot of DeFi (Decentralized Finance) protocols out there could be similarly exploited. The problems are rooted deep in how those DeFi protocols are designed to appeal to users: they are allowing you to work with otherwise locked assets, making it possible to use the staked token (such as stETH for example) to again take out a loan, which could in turn be used to again purchase Ether.

DeFi and Cascading Defaults

The Terra/Luna collapse should have been a wake-up call to many. Decentralized Finance is an experiment in real-time, a decentralized community experiment if you will, but it certainly is no solid and stable financial system that is battle-tested. Hence, what happens is that the market exploits these systems, ultimately improving decentralized finance. Until we are there, we will see a lot of blood and pain on the way.

An example of such a systemic exploit is the “Celsius Liquidity Crunch” which is linked to Lido’s staked Ethereum. The core idea of Lido’s value proposition lies in the idea that staked ETH (stETH) has parity with Ether – but on the example of the lending company Celsius (one of Lido’s clients) it has developed differently. One stETH (staked ETH on the Ethereum Beacon Chain) should always be worth 1 ETH. stETH has lost parity against ETH for quite some time, and it is not the only one.

Another prominent example is USDD, which is the stablecoin from Justin Sun’s ecosystem. It is a fork of Luna/Terra/UST. There will be blood.

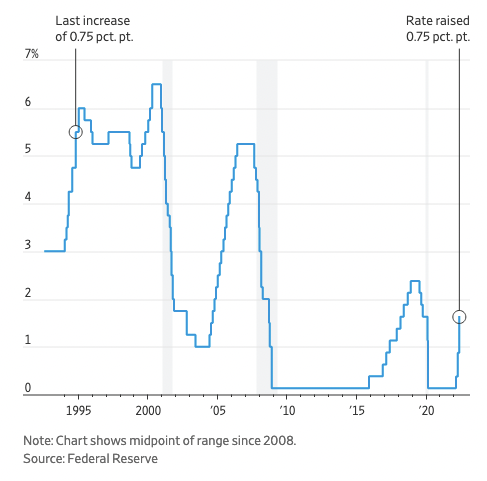

Federal Reserve raising benchmark borrowing rates by three quarters of a percentage point

On June 15, 2022, the Federal Reserve (Fed) has approved the largest interest rate increase since 1994 and also signaled that these rates will be further lifted (with a potential additional increase of 0.75 in a month). This has been the third time the Fed has raised interest rates in 2022, putting its benchmark interest rate at a range of 1.5% to 1.75%. Historically, these raises have created economic downturns because money gets pricier to borrow.

2022 continues to amaze, it is unbelievable how crypto and the financial markets became topic number one in this eventful times. Just as the media stopped to report on COVID-19, Bitcoin, and the S&P 500 steal the show. We will continue to see collapsing protocols, should people not aim for financial, technical and systemic literacy. A novel financial system which we create is not Free, as in Beer. DeFi needs responsible design and compliance to be taken seriously. On the other hand, the market will always test edge cases, especially if they potentially yield high returns.